by Claudius Woods

Going cashless is becoming the new norm in every society. Most people no longer want to have cash with them going around. They prefer their credit card with them.

Contents

This is because a credit card is safer and easier to carry about than physical cash. As a businessman or woman, you will be wrong to assume that all your customers will come to you having cash with them. You must innovate in the way you handle your business or you may get kicked out by competitors. One way you can innovate is to adopt cashless policy. You must be able to transact with your customers even when they don't have physical cash with them. Having a credit card reader proves to your customers that you are not ancient in the way you run your business. With this, they will be happy to do business with you. Besides gaining access to more customers, a credit card reader will also help you get paid faster. It is becoming very essential for you to have a credit card reader in this digital age.

In this post, we will consider the top 5 credit card readers you can adopt for your small business. The uniqueness of each of these readers is also highlighted. Look through the list and decide for yourself the one you feel will best serve your business.

You can check this best android apps for small businesses in 2023

Look through each of them and go for the one that best suit your small business.

PRODUCT | SWIPE + CHIP READER COST | FEES | DEPOSIT TIME | OTHER BENEFITS |

SQUARE | $49 | 2.6% plus $0.10 for swiped credit transactions and no other monthly charges. 3.5% + $0.15 for each Keyed in transaction with 2.9% plus $0.30 charges on invoice and E-commerce transaction. | 1 day | Low flat rates and no monthly fees. Offline mode. |

SHOPIFY | $29 | In-person transaction on basic plan costs 2.7% while online rates start at 2.9% plus $0.30 per transaction. With a monthly plan of $79, in-person fees drops to 2.5% and online credit card rates to 2.6% plus $0.30 per transaction. | 2 days | Robust inventory management. Free swipe reader. |

PAYANYWHERE | $19.99 | 2.69% per transaction for Pay As You Go package (basic package). Manually entered recurring payments, invoicing and transaction. Costs 3.49% + $0.19 for each transaction and $4 monthly fee for merchants who do not use the service for one year. With a monthly plan of $12.95, transaction fees drops to 1.69%. | 1 day | Lowest transaction fees. First device free with subscription. |

QUICKBOOKS GOPAYMENT | $19 | Pay as you go rates are 2.4% + $0.25 per swipe or 3.4% + $0.25 for each keyed in transaction. Invoice rates are 2.9% + $0.25. With a monthly plan of $20, transaction fees drops to 1.6% + $0.25 per swipe and 3.2% + $0.25 for each keyed in transaction. | 1 day | QuickBook's integration. Accept all payment type. |

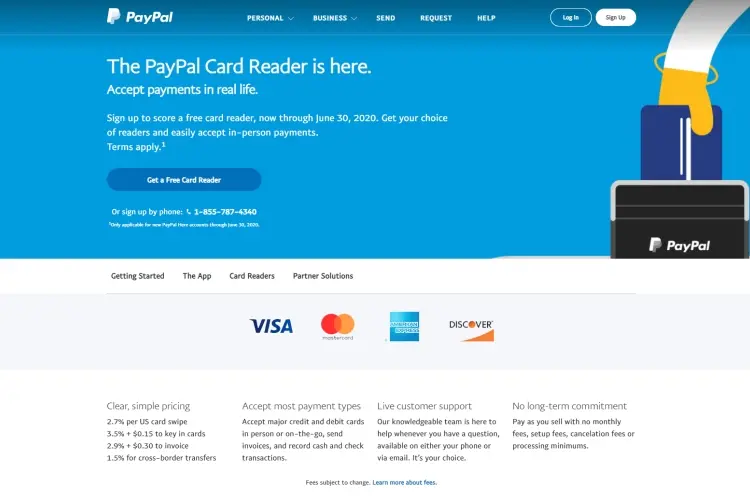

PAYPAL HERE | $19.99 | 2.7% for swiped credit transactions and no other monthly charges. 3.5% + $0.15 for manually entered payments and 2.9% + $0.30 for each invoice transaction. | 1 day. This is only possible with a Paypal Business Debit MasterCard®account. | Complete Paypal integration. No monthly fees. |

Here are the top 5 credit card readers for your small business for the year 2023.

Square has the best mobile credit card reader out there. If you need a quick and affordable way of accepting credit card payments, consider Square.

Features:

· It is best for low and simple fees transactions.

· Square's high-end security and encryption protection makes your money and information safe.

· Square's fees are the simplest, even though they are not the cheapest.

It has a charge rate of 2.6% plus $0.10 that covers transactions for swiped credit card and 3.5% plus $0.15 for keyed in transactions.

· For e-commerce transaction or invoice, you pay 2.9% plus $0.30. These fees do not involve any monthly subscriptions or extra per transaction fees.

· For chip-card and contactless payments, you can buy the Square Bluetooth-enabled reader for $49. You can pay this money once or in three monthly installments of $17.

· Signing up for Square gets you a free mobile magnetic stripe credit card reader. The company will ship this free credit card reader to you.

· In case of a power outage, Square's offline mode permits you to pay the same rate as swipe, for processing fee.

· The reader works with Square's free point of sales (POS) app to enable you to carry out payment transactions on your tablet or smartphone.

You can check this 5 Best Mobile POS App

Other benefits of using square include:

· The Square mobile credit card reader is easy to understand and set-up.

· Square accepts all major credit cards, including American Express. It also works on all IOS and Android mobile devices through its free companion point of sale app.

· Square's point of sales service app also offers:

i. Inventory management

ii. Invoicing

iii. Advanced reporting

iv. A free online store

v. A free customer database

· Your money gets deposited to your account within one to two business days.

CLICK HERE TO SIGN UP FOR SQUARE

Shopify is a platform that allows retailers to sell their products both online and in-person.

Features:

· The platform has an online store, card reader and a robust mobile app for both IOS and Android devices.

· Shopify's POS service costs $29 per month for the basic plan. With this plan comes:

i. Free swipe card reader for up to two users

ii. Access to retail reports

iii. Shipping label support and other services.

· In-person transactions on Shopify's basic plan cost you 2.7% while online rates start at 2.9% plus $0.30 per transaction.

· Shopify looks more expensive than other brands, but for small companies that do only occasional in-person sales, it pays using the service.

· Upgrading to more advanced plans on Shopify offers you better discounts. For example, the $79 per month plan has in-person fees at 2.5% and online credit card rates of 2.6% plus $0.30 per transaction. This plan is helpful for those planning to expand their physical retail presence or set up a more permanent store.

· You can upgrade to a Shopify tap and chip reader for $24 and a dock for the reader for $39. A chip and swipe reader cost $29.

With Shopify, you enjoy benefits which include:

· Shopify's app and readers works on all IOS and Android mobile devices and it accepts all major credit cards.

· Access to Shopify's customer support 24/7.

· Funds transfer to your account takes between 1-3 days.

· Shopify's services are not standalone services. The mobile card reader comes as an extension to other existing Shopify services.

CLICK HERE TO SIGN UP FOR SHOPIFY

Payanywhere is a simple system that provides you with next-day funding.

Features:

· It offers you a free credit card reader

· It also has the lowest charges.

· For its basic package, Payanywhere fee is 2.69% per transaction.

· 3.49% with additional $0.19 on invoicing, recurring and keyed in transactions payment on each transaction.

· $4 monthly charges for merchants who fail to use the service for a year

· You can also sign up to standard plans where you get a further drop in transaction fee to 1.69% per swipe.

· Payanywhere's POS mobile app offers:

i. Personalized receipts,

ii. Inventory reporting,

iii. Customer purchase reporting,

iv. Invoicing,

v. Online resources and

vi. Multilingual customer support at no extra cost.

· The app also lets you synchronize your Payanywhere transacations to an intuit QuickBooks online account.

· Free 2-in-1 reader ($30 fee for an extra unit.)

· It allows Magstripe cards and EMV chip

· $50 for its 3-in-1 reader. It accepts:

i. EMV chip cards,

ii. Magstripe cards, use QuickBooks to run payroll and

iii. NFC contact-less payments.

You can check How To Us Samsung Pay

Benefits of using Payanywhere includes:

· Payanywhere's free card reader has no setup, monthly, hidden or any subscription fee.

· Payanywhere's mobile payment processing app is easy to use and is customizable.

· It allows you add unlimited users to your merchant services and account.

· Payanywhere's charge is flat for all cards, including American Express.

· Payanywhere's card readers is compatible with most Apple IOS and Android smartphones/tablets.

· Payanywhere's SDK allows you to include payment for your company proprietary app if available.

CLICK HERE TO SIGN UP FOR PAYANYWHERE

The next on our list of credit card readers for your small business is Gopayment. Gopayment is owned by the financial software company Intuit.

Features:

· It is integrated with QuickBooks software. This makes it the best mobile card reader for businesses that already makes use of QuickBooks accounting and sales software.

· If you are a QuickBook user, GoPayment gives you the advantage of getting payments recordeddirectly to your QuickBooks account.

· You don't need to be a QuickBook user to process with GoPayment.

· QuickBooks GoPayment offers two different plans;

i. The Pay As You Go:

It has a close rate of 2.4% with $0.25 for each swipe or 3.4% with $0.25 per transaction for a keyed in entry.

ii. A monthly plan.

The rate is lower and it has a monthly fee.

· The all-in-one QuickBooks card reader costs $49.

· It accepts:

I. Apple Pay

II. Google Pay

III. Samsung Pay

IV. EMV chip and

V. Magstripe debit and credit card.

· It also includes a docking station.

· With this reader, you can connect your phone or tablet via Bluetooth using the GoPayment app.

You can check How To Use Google Pay

You enjoy the following benefits using QuickBooks GoPayment:

· Signing up for a QuickBook service gets you a free bluetooth enabled card reader which can handle both magstripe and chip methods of entry.

· Small businesses use QuickBooks to run inventory, payroll, sales

· Setting up GoPayment's service does not require any setup fee.

· The GoPayment app has a clean interface that makes it easy to use and it works on all IOS and Android devices.

· Fundsare transferred to your account a day after paymentis made and areautomatically recorded and synchronized with QuickBook.

CLICK HERE TO SIGN UP FOR QUICKBOOK'S GOPAYMENT

Paypal Here is one of the best mobile credit card processing providers when it comes to hardware.

Features:

· It is good for businesses that accept credit card transactions at a variety of venues.

· The venue may be retail spaces, offices or even events.

· Paypal's credit card processors are Bluetooth-enabled. This means that you can accept payments from within any range of your mobile device.

· When you set up a Paypal Here plan, you get a free starter mobile card reader.

· This reader can either be;

i. A basic mobile card reader

ii. A chip or

iii. Swipe reader.

· The original cost of the basic mobile card reader is $14.99 and that of the chip and swipe is $24.99.

· There is a good integration of the card reader with Paypal's other merchant services. This makes it easy to accept in-person and online payments from anywhere.

· To enjoy the best value with Paypal Here, you need to upgrade to Paypal's Chip and Tap Plus Charging stand.

· This $80 reader, allows you to do contactless, chip, and magstripe transactions.

· If you run high volume transactions, it is best you upgrade to this reader.

· Paypal Here swipe transaction fees are at a flat rate of 2.7%, with no subscription or other hidden fees.

· Keyed-in-entries has a flat rate of 3.5% plus $0.15, and invoices cost 2.9% plus $0.30 each.

Benefits of using Paypal Here include:

· Paypal Here allows you to make instant transfers to your Paypal account. You can also move funds from your Paypal account to bank account for a nominal fee of $0.25.

· You can accept all forms of payment with Paypal Here, using its mobile iPhone, Android, or Windows app. You can also use your own Paypal account to send and receive funds.

· With the Paypal's Here IOS and Android app you can have a personalized design of:

i. Profile

ii. Receipts

iii. Track sales

iv. Invoices

· You can also run inventory, add many users and access lots of online tools and resources.

· Though PayPal Here does not allow next-day funding, you can still get your payments as fast as one business day when you sign up for Paypal's Business Debit Mastercard®.

· If you sell online using Paypal, you get all your data synchronized up. This could be a big source of attraction for your business.

CLICK HERE TO SIGN UP FOR PAYPAL HERE

If you get confused trying to decide on the credit card reader to choose for your business, consider your business particular needs. You may ask yourself questions like; do I sell online or only in-person? What is my business monthly processing volume? Providing answers to these questions will help you in deciding. If your business is small scale and focus only on some events, the pay-as-you-go package may be the best for you. For a higher volume operation, you may consider a lower per transaction fee. There is no one for all reader, but all-round, Square is the best and can work for any industry. As you make up your mind on the card reader to choose, ensure you go for both a chip card and contact-less payment system. Highlighted below are other small business payment processing solutions for you to consider.

· ROAMpay

· SumUp

About Claudius Woods

Claudius began his blogging journey in the early 2000s, sharing his experiences and knowledge about Microsoft Windows on his dedicated website. His ability to simplify complex technical concepts and provide practical solutions to common Windows-related issues quickly gained attention within the tech community.

|

|

|

|

Popular Posts

Receive FREE Stuff Daily here. You can also shoot for Freebies nothing but good stuff.

Once done, try any button below

|

|

|

|