by Claudius Woods

When you apply for a credit card, there are risks of getting your request denied by the reviewers. However, you can ask them to reconsider your request immediately. Whereas, if you want to reach the minimum spending requirement set by respective card issuer company for its welcome bonus by maximizing your purchases, you can request an immediate card number until it you receive the physical copy in your mail. Not every card issuer offers an instant card number, so you have to make sure that you have chosen the right one.

In this guide, we are going to tell you about the best companies that are out there to issue you an immediate card number upon the approval of your request. We want the best for you! Trust us, and keep reading the guide till you find the company that is the one for you!

Contents

Back in the time, applicants were supposed to copy down their card number on the spot, because they won't be able to request it later. Now, you can request American Express to view your card number, and you have it! Once your account is approved by American Express, you are considered to be a valid identity. Hence, American Express sends you the card number immediately upon approval.

If you're wondering about how it works, let's tell you! Upon request, American Express sends you the original credit card number online via email. When you will receive the physical copy of the card in your mailbox, the number will be as same as the email one. However, the Amex four-digit card identification number will be different. This is why you might need to hold off using it for recurring payments.

There are many queries about how co-branded cards work with their instant card number. There's no major difference. However, some of the co-branded card numbers are mostly applicable to the cobrands only.

To make it easier for you to understand, we have created a list of all the American Express cards that offer instant card numbers.

Contents

· The Platinum Card from American Express

There is so much that you can avail of by opting for this one! If you are a fan of airport lounges, let us tell you that by using the instant credit card numbers, you can get access to a huge variety of airport lounges. As surreal as it may sound, the process will be much easier for you! All that you have to do is show the screenshot of your card number sent to you by email, and that's it! By doing so, you can get instant access to the American Express Global Lounge Collection including Delta Sky Clubs and Centurion Lounges. All of this before your physical card comes in your hands! How amazing is that?

| Welcome Bonus | After spending the amount of $5,000, you can earn 60,000 bonus points. However, this offer is only valid to be used within the 3 months of approval. |

| Earning Rates | If you book your flights and hotel facilities via Amex Travel or directly through the airline, you will be earning 5x points. Whereas, you can earn 1 bonus point every time you spend a dollar anywhere. |

| Annual Fee | $550 |

To watch what the reviewers have to say about this card, navigate to the video link below:

By using this one, you can get up to $120 in dining credits per year. You can use this amount at Boxed, Grubhub, The Cheesecake Factory, Seamless, and Shake Shack locations. Not just that, but you can also get $100 airline fee credit.

| Welcome Bonus | Within the first three months of approval, if you spend $4,000 on purchasing, you will be rewarded by 35,000 membership rewards. |

| Earning Rates | On dining worldwide and at supermarkets that are US-based, it will be 4x points. |

| Annual Fee | $250 |

· Hilton Honors Aspire Card from American Express

| Welcome Bonus | On spending $4,000 on purchases, get 150,000 bonus points offered by Hilton Honors. This offer is valid until first three months of approval. |

| Earning Rates | At Hilton Properties, earn 14x points, 7x points on booking your flights by using Amex travels, and much more! |

| Annual Fee | $450 |

Bank of America provides its customers with instant credit card numbers on the approval of Alaska Airlines Visa Signature credit card.

However, you need to start spending the required amount as soon as your card gets approved, because this credit card company is only offering a limited-time welcome bonus.

According to The Points Guy, Barclays doesn't provide you with an instant card number. However, if you apply for the Uber Visa Card, you can get exclusive deals on your Uber rides by using the code.

Being the issuer of one of the top-rated credit cards, Capital One Venture, Capital One used to serve its customers with instant numbers. Recently, this offer has been canceled. You should keep up with the official website because this offer can be revived soon.

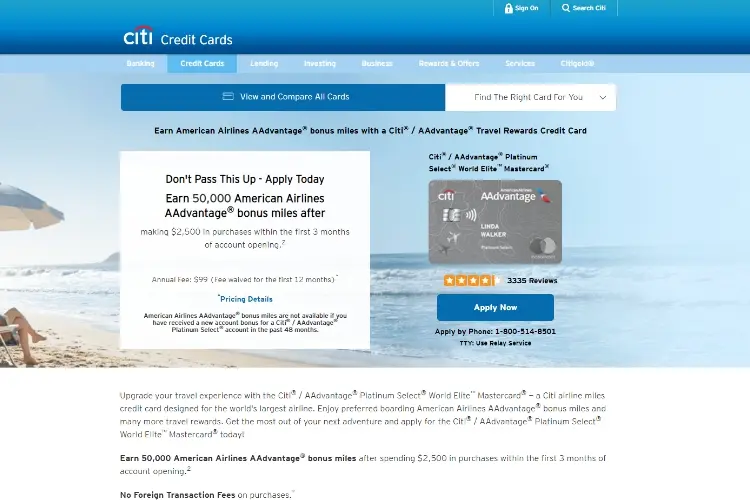

This card has a lot to offer! There is nothing basic about this card! It has to offer some elite perks to you! Those perks include a free checked bag, inflight discounts, and priority boarding. Not just that, but on spending an amount of $20,000 in a calendar year and get the card renewed, you will get a $125 discount on American Airlines flights.

| Welcome Bonus | On spending $2,500 in initial three months, you can get 60,000 points. |

| Earning Rates | You can get 2 miles by spending per dollar on eligible American Airline purchases, gas stations and restaurants. You can get 1 mile on spending each dollar anywhere. |

| Annual Fee | $99 |

When you apply for a credit card, you are likely to receive any one of the following responses:

· Immediate Approval

· Pending

· Request Denied

In case of receiving the first response; being approved, the issuer will further sent you an email, asking you whether you'd like to have instant card number or not. Otherwise, receiving an instant approval won't enable you to use your credit card unless its physical copy arrives in your hands. However, upon receiving and using the instant card number, you can begin using it right away.

Although, there is no big difference between the two, there are a few facts to understand in order to become familiar with both terminologies.

The basic and most important thing to understand is that neither of the two refers to any guarantee regarding the request approval. If you are told that your account is pre-approved or pre-qualified, it means that it is yet to be qualified for approval after a round of certain formalities.

Being pre-qualified means that you'd have to go through a less extensive formality round. Whereas, being pre-approved means that you have to go through a few serious formalities such as submitting your credit history before being approved.

Once your request for issuing yourself a credit card is approved, you are likely to receive your physical credit card in 5 to 7 business days. However, the duration varies, for example, if we talk about the American Express Platinum Card, an overnight shipping procedure would be followed. Expedited shipping can be granted to customers as per their request, but there is no guarantee of it being approved.

If you don't remember or can't find the PIN of your credit card, you should approach the credit card issuer company through its website or mobile applications, and submit your query there. You can also contact them through making a call, and present your concern to them. However, the authority takers might not repeat your original credit card PIN on the call; you can always make a request of having a new one.

If you are a MasterCard, Visa or Discover user, your credit card's CID is a 3-digit number that is located on the backside of your card, just above the signature strip.

If you are an American Express Credit Card user, your CID is the 4-digit number that is located on the front-side of your card. Usually, it is present on the above of your credit card's main number, either on the right or left side.

CID is an identification code of your credit card that keeps you safe from fraud and scams. It is used to make sure that the real owner of the card is using it.

In this guide, we tried our best to tell you about the top credit card issuer companies that offer instant credit card numbers that can be used until the physical form of credit card arrives in your hands. We also answered some of the frequently asked questions about credit cards.

If you found this article helpful, don't forget to share it with your friends and family!

Thank you!

About Claudius Woods

Claudius began his blogging journey in the early 2000s, sharing his experiences and knowledge about Microsoft Windows on his dedicated website. His ability to simplify complex technical concepts and provide practical solutions to common Windows-related issues quickly gained attention within the tech community.

|

|

|

|

Popular Posts

Receive FREE Stuff Daily here. You can also shoot for Freebies nothing but good stuff.

Once done, try any button below

|

|

|

|